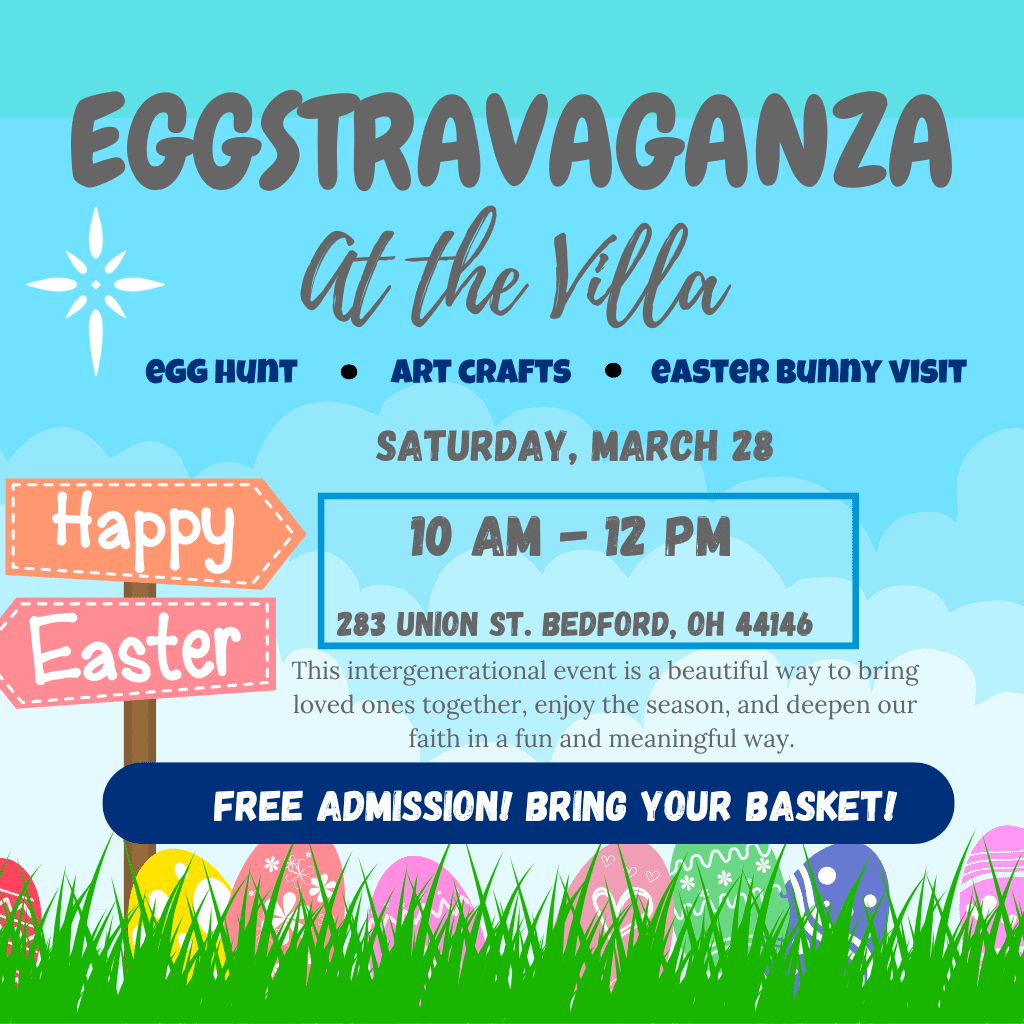

Eggstravaganza at the Villa!

On Saturday, March 28 at 10 AM, families and friends are invited to bring their little ones for an Easter Egg Hunt across the Villa!

Light of Hearts Villa is proud to partner with FreeWill, a trusted online resource that allows you to create a legally valid Will for free—whether or not you choose to leave a gift to support our mission. Through FreeWill, you can also make a direct stock gift, contribute through your IRA, recommend a grant from your donor-advised fund (DAF), or donate cryptocurrency with ease. These tax-smart giving options provide a meaningful way to support our residents while maximizing your financial benefits.

Planning ahead ensures your values and legacy live on. Explore your options today—at no cost to you.

Include a gift for Light of Hearts Villa in your will or trust, designating a specific dollar amount or percentage.

To help you get started on your plans and legacy, you can use FreeWill, an online tool that guides you through the process of creating your will or trust. It’s easy to use, accessible online, and can be completed in 20 minutes. You can use this resource on its own, or use it to document your wishes before finalizing your plans with an attorney.

Have you already included a gift in your will or trust? Please fill out this form to let us know! We would love to thank you for your generosity.

Do you have an IRA, 401(k), life-insurance policy, or any other assets not included in your will? If so, these are called non-probate assets and you must plan your beneficiaries for them separately. Use this online tool to make your plans and designate us as a beneficiary of one or more of these assets.

A charitable gift annuity (CGA) is a unique way to support Light of Hearts Villa while also securing financial benefits for yourself or a loved one. When you establish a CGA, you make a donation of cash or appreciated assets to Light of Hearts Villa in exchange for fixed, lifetime payments. These payments provide a steady income stream, offering financial security while allowing you to contribute to a mission that is close to your heart.

Benefits of a Charitable Gift Annuity:

A charitable gift annuity is a win-win opportunity, providing peace of mind and a lasting impact on the future of Light of Hearts Villa.

If you would like to learn more about how a CGA can fit into your financial planning, we would be happy to discuss your options. Contact Amy Huntley at 440.232.1991 ext. 524 or amy.huntley@lightofheartsvilla.org for a confidential conversation about your legacy giving goals.

By contacting our Director of Mission Advancement & Communications, Amy Huntley at 440.232.1991 ext. 524 or amy.huntley@lightofheartsvilla.org or by completing an Estate Provision Intention form and returning it to Light of Hearts Villa.

Light of Hearts Villa

283 Union St.

Bedford, OH 44146

Tax ID Number: 34-1619270

"*" indicates required fields

On Saturday, March 28 at 10 AM, families and friends are invited to bring their little ones for an Easter Egg Hunt across the Villa!

As we celebrate the 175th Anniversary of the Sisters of Charity of St. Augustine, we invite you to join us for a special afternoon of prayer and gratitude on Wednesday, April 29.

We are thrilled to share exciting news with our community — Light of Hearts Villa has officially received a deficiency-free rating on our 2025 Annual State Survey conducted by the Ohio Department of Health!